What do I need to know to import from the EU after Brexit?

The UK has now left the EU, and is classed as a 3rd country in regards to trade to and from the continent. An FTA was agreed on 24/12/20 which eliminates duty on goods of preferential origin. January 1st 2021 saw new regulations come into force when it came to importing goods to the UK from the Continent and Northern Ireland.

Importing goods after Brexit has proved to be a very different procedure for many clients who were used to the previous EU regulations.

Operating post Brexit means customs clearance procedures and import tariffs are now in place for bringing goods into the UK, which is why here at Speedy Freight here to help our clients with their import compliance.

Step 1 – Get an EORI number

As a business owner, you need to make sure that your business has an Economic Operator Registration and Identification Number (EORI). In order to continue importing goods into the UK, you will need to have a 12-digit EORI starting with GB. You may not need an EORI number if your business is service-based or if you want to move goods between Northern Ireland and Ireland. If your business does not have an EORI number, then you might face delays and increased costs while importing goods.

Check what documents you may need to apply for an EORI number here.

Step 2 – Make import declaration

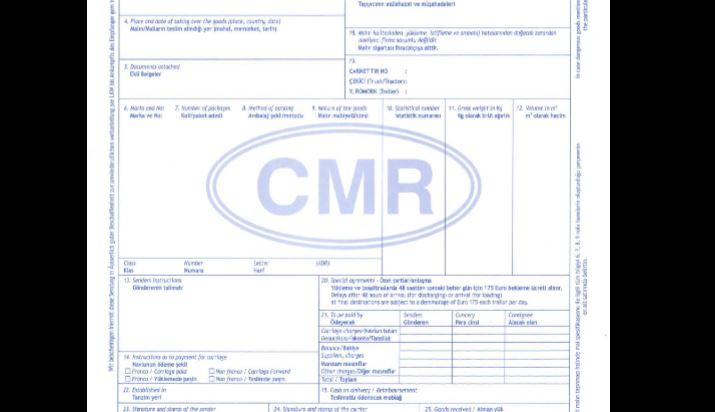

To make import declarations, you can either hire an agent or do it yourself.

HIRING A CUSTOMS AGENT

Freight forwarders, brokers, and fast parcel operators are some of the types of agents who can handle customs for you. To help you with imports from the EU, they must be established in the EU.

Freight forwarders can assist you with moving the goods around the world. They can even make arrangements to help you get customs clearance.

Brokers or custom agents ensure clearance through customs.

Fast parcel operators can help you move documents, parcels, and freight across the world within a specific time frame. They can even handle customs clearance for you, provided you give them written instructions. The instructions must clarify whether these agents are acting for you directly or indirectly. If your business is new and you are still in search of a customs agent, you can find one from HMRC’s list of customs agents.

DECLARING IMPORTS YOURSELF

If you are making customs import declarations by yourself, there are three important things for you to know when you import from outside the UK: how to submit, when to submit, and which boxes to complete.

a. How to submit – If you are submitting your declarations on your own, they have to be sent electronically through the Customs Handling of Import and Export Freight (CHIEF) system. To do this, you must first apply to gain access to CHIEF and then buy third-party software to submit declarations electronically via CHIEF.

While moving merchandise in baggage or small vehicles, you will need to submit a full declaration in advance if the goods meet any of the following conditions:

– the value of goods is over 900 Euro

– the goods weigh more than 1,000 kg

– you are moving excise or restricted goods

– the goods need a license

– you are planning to claim relief

b. When to submit – Under normal circumstances, a business owner must submit a complete declaration when goods are entering the UK. If you are moving your goods to temporary storage under customs supervision, they can remain in storage for 90 days. If the 90-day time limit is exceeded, you will need to pay the duty, VAT and penalty.

The declaration process may vary if you are using the simplified declaration procedure or operating under an EIDR (entry in declarant’s record) authorization.

In the event of a no-deal Brexit, if you are using transitional simplified procedures, the goods you import from the EU might get delayed. This is because it may take longer than usual for you to submit a full declaration and pay your import duties and VAT.

In the event of a no-deal Brexit, you can still utilise the roll on roll off ports or the Channel Tunnel to import goods from the EU. You may need to produce customs declarations and pay any excise duty or VAT.

c. Boxes to complete – Each time you are moving goods, you must include the commodity code in your customs declarations. You may also have to include the Customs Procedure Code (CPC), which identifies the customs procedure applied while moving the goods.

Step 3 – Making importing easier

There are other customs procedures designed to streamline the process, like the Common Transit Convention (CTC), which simplifies the way in which goods get transported between or through the EU and the common transit countries.

If your business imports goods frequently, you can set up a duty deferment account. This allows you to make one payment per time interval (for instance, a month), instead of making payments every time you import something.

Step 4 – Check the tax and duty rates to be paid

For every import, you will have to pay custom duties and VAT. If the UK leaves the EU without a deal, the custom duty tariffs for imports from the EU and the rest of the world will change. Reports say that the temporary rates will be applicable for up to 12 months until the government completes its public consultation and introduces a permanent tariff regime.

Based on where the goods come from, the tariff rates can be classified as either preferential (also called Most Favoured Nation or MFN) and non-preferential.

A preferential tariff rate will be applicable on goods if the country they are imported from has trade agreement with the UK and is a part of the UK’s generalised scheme of preferences.

Non-preferential tariffs will be applicable for those countries which do not hold an official trade agreement with the UK and will eventually have to comply with the trade regulations set up by World Trade Organization (WTO). You can find out what the non-preferential tariff rates will be in case of a no-deal Brexit here.

If you have registered your business for VAT, then you will have to pay your import VAT while filing your VAT return. If your business involves the import of alcohol, tobacco, or biofuels, you will have to pay excise duties also. You can find the rates for excise duties here.

Step 5 – Get the right type of licence for the type of goods you import

Based on what kinds of goods you are moving into the UK, you may be required to have a special license or certificate. For some goods, you may even have to pay an inspection fee. You can check whether you need licenses for the goods you are importing here.

Trade Support Services for Import & Export UK

You may get help with supporting services in UK. Read our Trading support services for import and export articles for more information.