What do you need to know before Importing goods from Turkey to UK?

Free Trade Agreement (FTA)

The first thing you need to know is the ‘FTA’.

On 28 December 2020, the United Kingdom and Turkey concluded a Free Trade Agreement (the “FTA”) to ensure the continuity of their trade following the United Kingdom’s exit from the European Union (“EU”).

For more information about FTA, Please read the article: The Free Trade Agreement Between Turkey and United Kingdom.

It was estimated that without a deal, 75 percent of Turkish exports to the UK would have been subject to tariffs, leading to losses amounting to an estimated $2.4bn in 2021.

The previous UK-Turkey trade relationship was regulated principally by the EU-Turkey Customs Union, together with agreements on agriculture and coal and steel. It was therefore of paramount importance to both countries, given the volume of trade between them, to agree on trading arrangements once the UK exited from the European Union.

Preferential tariffs

The deal also means UK businesses sending steel, iron, and machinery to Turkey will be protected by preferential tariffs.

When importing goods from Turkey, you must declare that your goods comply with the rules of origin so you can benefit from preferential tariffs. You must be able to provide proof of this.

Many different sectors of the Turkish economy present real opportunities for British exporters including healthcare, advanced manufacturing, financial services, IT and automotive and it is anticipated that a second phase of the FTA, proposed in the near future, will play an even more important role in bilateral trade between the two countries.

Making your import declaration

You will also need to include the commodity code when making your import declaration. The code determines how much duty you need to pay and whether an import license is required.

As the UK has a trade agreement with Turkey, you may be able to pay less or even no duty on the goods. If you can’t pay a lower rate of duty, you may still be able to delay the payment.

Goods that you may need a special license or certificate to import include plants, animals, high-risk foods, medicine, chemicals, and weapons.

1. Check if you need a VAT registration

Before Brexit, many EU businesses used to operate under EU simplifications such as call-off stock or triangulation rules. These rules no longer apply and therefore foreign businesses will need to get a UK VAT number in order to import their products in UK.

2. Get an EORI number

You should get a UK EORI number in order to make imports. UK EORI numbers are different from EU EORI numbers. You will need to apply for this number if you did not have it before 2021 or if you had only an EU number. The application process is easy and you can get a response from HMRC in a few days.

3. Understand and agree incoterms with your supplier

Incoterms are a set of terms and conditions that establish the rights and responsibilities of both the buyer and the seller in international trade. They are important for customs purposes because they may define who is responsible for a given customs obligation. For example, if you are a non-UK company exporting your goods from an EU country under DDP incoterms, you will be responsible for the export in the country of departure and import in the UK (both). If, however, you are selling under EXW incoterms, you will not take care of the export in the country of dispatch, nor the import in the UK.

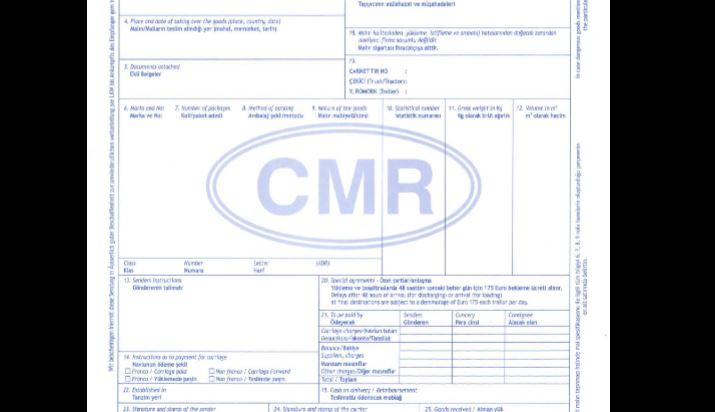

4. Decide if you will use an agent for completing customs documents

Most businesses find an external provider to handle customs documents on their behalf. This documentation is complex and requires training, staff availability, and an application for a CHIEF badge.

Most transport companies, freight forwarding companies, and carriers can act as an agent. You can check HMRC website to find an agent to help you or contact us to get a free quote.