Charges for Import and export from Turkey

Importation of goods and services is a taxable transaction, whether or not the importation is made for business purposes.

You may find custom tariff rates of Turkey here.

Export transactions are exempt from VAT, and credit and refund is available for input VAT for the export goods.

All the goods, other than those whose exportation is prohibited by laws, decrees and international multilateral and/or bilateral agreements, can be freely exported within the framework of the Export Regime Decree.

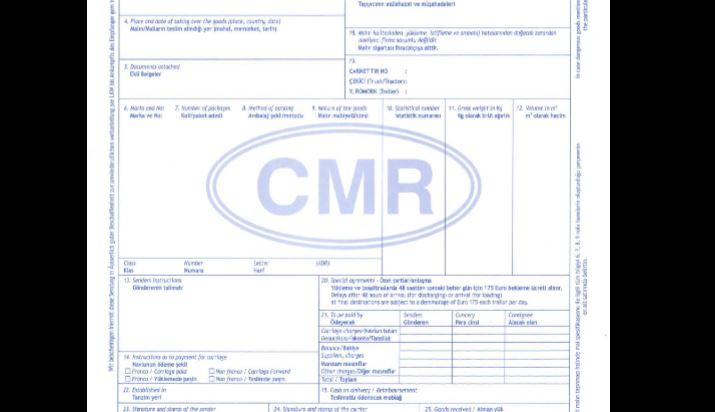

Goods to be exported from the Customs Territory of Turkey are declared to the authorized customs administration by the customs declaration.

Documents like oral declaration form, special invoice, victual list can also be used for the declaration of export, besides customs declaration.

Turkish Tariff Nomenclature (HS Code)

The twelve digit code used in Turkish Tariff Nomenclature is called “Customs Tariff Statistics Positions (GTIP)”. The first six digits of this code indicate Harmonized System (HS) code, which is used within the World Customs Organization member countries, 7-8th digits indicate Combined Nomenclature Code, which is used within the European Union Member Countries, 9-10th digits indicate national subheadings which has opened because of our country’s different tax applications, and 11-12th digits indicate the statistical codes.

For example;

540761 90 90 11

HS Code CN Code National Subheading Statistical Code

Importation of goods and services

For VAT purposes, any importation of goods or services into Turkey is a taxable transaction, regardless of the status of the importer or the nature of the transaction. To equalise the tax burden on importation and domestic supply of goods and services, VAT is levied only on the importation of goods and services that are liable to tax within Turkey.

Accordingly, any transaction exempt in Turkey may also be exempt on import. The VAT on importation is imposed at the same rates applicable to the domestic supply of goods and services.

In the case of importation, the taxable event occurs at the time of actual importation. Importation of machinery and equipment under an investment incentive certificate (IIC) is exempt from VAT.

Importing from Turkey and customs in the EU

Even though Turkey is not a member of the EU, in 1995 it became a part of the European Union Customs Union. What it means is that in most cases importers from Turkey to the EU do not need to pay customs. This can be clearly seen on the website of TARIC – Integrated Tariff of the European Communities. There, custom codes and customs rates for all EU countries are available. When you find the category of product you are interested in (e.g. with the help of browsing or a textual search), click on its HS code. By clicking “retrieve the measures,” you will be on the product’s site.

Value-added tax (VAT) in Turkey

Deliveries of goods and services are subject to VAT at rates varying from 1% to 18%. The general rate is 18%.

VAT payable on local purchases and on imports is regarded as ‘input VAT‘, and VAT calculated and collected on sales is considered ‘output VAT‘. Input VAT is offset against output VAT in the VAT return filed at the related tax office. If output VAT is in excess of input VAT, the excess amount is paid to the related tax office. Conversely, if input VAT exceeds output VAT, the balance is carried forward to the following months to be offset against future output VAT. With the exception of a few situations, such as exportation and sales to an investment incentive holder, there is no cash refund to recover excess input VAT.

Turkish VAT principles contain a ‘reverse-charge VAT mechanism’, which requires the calculation of VAT by resident entities on payments to persons in foreign countries. Under this mechanism, VAT is calculated and paid to the related tax office by the resident entity. The resident entity treats this VAT as input VAT and offsets it in the same month. This VAT does not create a tax burden for the resident or non-resident entity, except for its cash flow effect on the former if there is insufficient output VAT to offset the input VAT.

VAT is also collected at the point of import. The VAT rate is the same rate as the one that is applied for transactions in the country of origin. The base for VAT is the value of the goods for customs tax purposes plus any kind of tax payable at the point of import and all the expenses incurred until the single administrative document is registered.

Export Regime

Export Regime is the regime underwhich the goods in free circulation are taken out of Customs Territory of Turkey with the purpose of export.

Returned Goods

If the goods in free circulation which, having been exported from the Customs Territory of Turkey or from another point of the customs territories of the customs union to which Turkey is a party, are returned to that territory and re-released for free circulation within a period of three years, they obtain the returned goods status. The returned goods, upon request of the declarant, are relieved from import duties only if the goods are reimported in the state in which they were exported. The three-year period may be exceeded due to unforeseeable conditions and force majeur.

The relief from import duties can not be granted in the case that:

(a) The exported goods couldn’t be released for free circulation or be assigned of a customs-approved treatment or use due to the rules in force in the country of destination.

(b) The exported goods are rejected by the importer since they are defective or do not comply with the terms of the contract,

(c) The exported goods couldn’t be assigned of a treatment or use intended because of unavoidable reasons.

And the proof of the circumstances by the documents, which are received from the buyer or authorized bodies out of the Customs Territory of Turkey, is required.

Goods taken out of Customs Territory of Turkey

Goods, taken out of the Customs Territory of Turkey, are subject to the customs control and they are exported through predetermined routes under supervision of the customs administration.

For the goods which are to be taken out of the Customs Territory of Turkey, a customs declaration or where lodging a customs declaration is not required a summary declaration is lodged at the customs administration of exit.

The exit summary declaration is lodged by the carrier. Notwithstanding the obligations of the carrier, the exit summary declaration may be lodged instead by one of the following persons:

(a) The exporter or consignor or other person in whose name or on whose behalf the carrier acts,

(b) Any person who is able to present the goods in question or have them presented at the customs administration of exit.

In addition, an exit notification is lodged by the carrier or the representative of the carrier at the customs administration of exit.

Need Help Importing Products From Turkey?

Albatross Shipping LTD UK can provide verified suppliers in Turkey with collaborating branch. We can cross verify products in Turkey and help you importing from Turkey to United Kingdom. If you are already existing importer from Turkey then contact us to get verified source in Turkey to gain competitive advantages for your business.