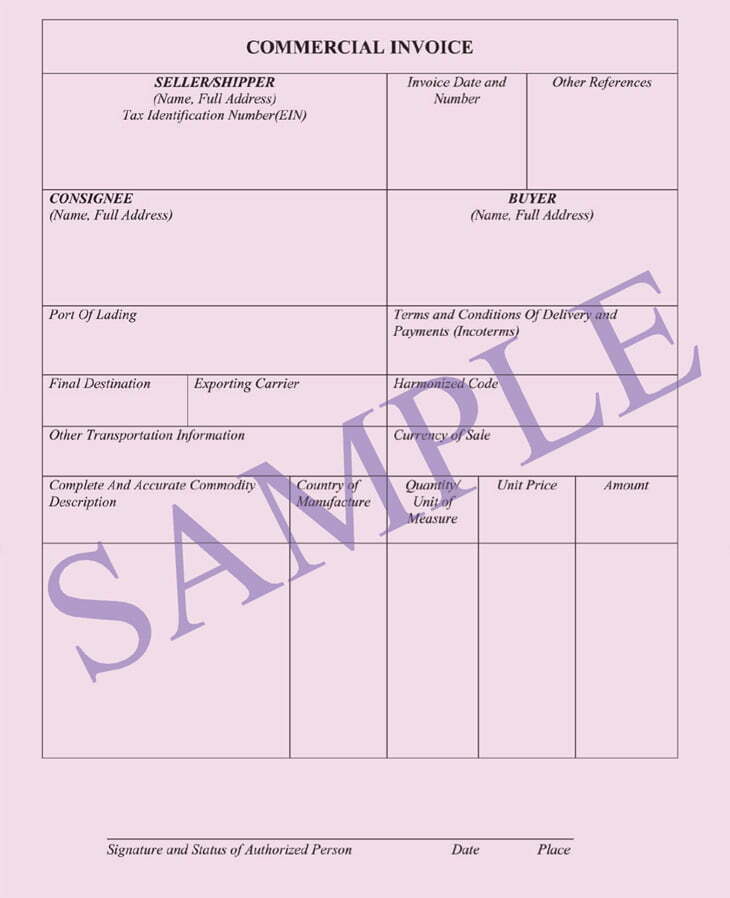

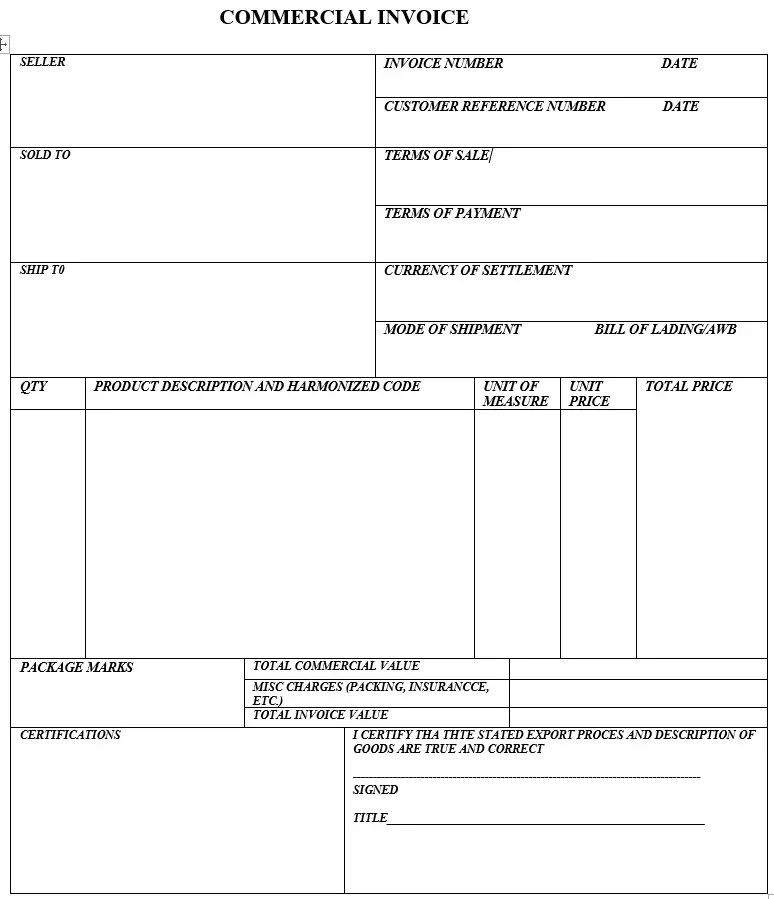

COMMERCIAL INVOICE INSTRUCTIONS

1. SELLER – Name and address of principal party responsible for effecting export from the Unites States. The Exporter as named on the exporter license (if applicable.

2. SOLD TO – The name and address of the person/company to whom the goods are shipped to for the designated end use, or to the party so designated on the export license.

3. SHIP TO – If different than Sold To)The intermediate consignee – that is the name and address of the party who effects delivery of the merchandise to the ultimate consignee, or the party so named on the export license of the forwarding agent. The name and address of the duly authorized forwarder acting as agent for the exporter.

4. INVOICE NUMBER – Invoice number assigned by the exporter.

5. CUSTOMER REFERENCE NUMBER – Oversees customer’s reference number.

6. TERMS OF SALE – Delivery and terms of sale agreement.

7. TERMS OF PAYMENT – Terms, conditions, and currency of settlement as agreed upon by the vendor and purchaser per the pro forma invoice, customer purchase order and/or the letter of credit.

8. CURRENCY OF SETTLEMENT – Currency agreed upon between seller and buyer as payment.

9. MODE OF SHIPMENT – Indicate air, ocean, and surface.

10. QUANTITY – Record total number of units per description line.

11. DESCRIPTION – Provide full description of items shipped, the type of container, (carton, box, etc.) the gross weight per container, and the quantity and unit of measure of the merchandise.

12. UNIT OF MEASURE – Record total net weight and total gross weight in kilograms (1 kilogram = 2.2 pounds) per description line.

13. UNIT PRICE – Record the unit price of the merchandise per unit of measure.

14. TOTAL PRICE – Calculate the extended value of the line.

15. TOTAL COMMERCIAL VALUE – Total value of the invoice.

16. PACKAGE MARKS – Record in this field and on each package number (for example, “1 of 7,””3 of 7”) shippers company name, country of origin (e.g., Made in USA), destination port of entry, package weight in kilograms, package size (length x width x height) and shipper’s control number (optional).

17. MISCELLANEOUS CHARGES – Charges (packing, insurance, etc. Record any miscellaneous charges that are to be paid by customer, such as export transportation, insurance, export packaging inland freight to peer, etc.).

18. CERTIFICATIONS – Any certifications or declarations required of the shipper regarding any information recorded on the commercial invoice.

Commercial invoice requirements when clearing or filing entry documents with U.S. Customs and Border Protection

The commercial invoice, or the documentation acceptable in place of a commercial invoice, shall be submitted with the entry and before release of the merchandise is authorized. The commercial invoice or other acceptable documentation shall contain:

- An adequate description of the merchandise.

- The quantities of the merchandise.

- The values or approximate values of the merchandise.

- The appropriate eight-digit subheading from the Harmonized Tariff Schedule of the United States.

The port director may waive this requirement if he is satisfied that the information is not available at the time release of the merchandise is authorized.

- The name and complete address of the foreign individual or firm who is responsible for invoicing the merchandise, ordinarily the manufacturer/seller, but where the manufacturer is not the seller, the party who sold the merchandise for export to the United States or made the merchandise available for sale.

Information not required when filing entry. The commercial invoice or substitute document filed with the entry documentation also may include any other invoice information required. However, if the information does not appear on the invoice or substitute document filed with the entry documentation, it shall be included in the invoice or substitute document delivered at the time the entry summary documentation is filed.

Commercial Invoice Requirement in Details For USA

A commercial invoice, signed by the seller or shipper, or his agent, is acceptable for CBP purposes if it is prepared in accordance with Section 141.86 through 141.89 of the CBP Regulations, and in the manner customary for a commercial transaction involving goods of the kind covered by the invoice.

Importers and brokers participating in the Automated Broker Interface may elect to transmit invoice data via the Automated Invoice Interface or EDIFACT and eliminate the paper document. The invoice must provide the following information, as required by the Tariff Act:

- The port of entry to which the merchandise is destined

- If merchandise is sold or agreed to be sold, the time, place, and names of buyer and seller; if consigned, the time and origin of shipment, and names of shipper and receiver,

- A detailed description of the merchandise, including the name by which each item is known, the grade or quality, and the marks, numbers, and symbols under which it is sold by the seller or manufacturer to the trade in the country of exportation, together with the marks and numbers of the packages in which the merchandise is packed,

- The quantities in weights and measures,

- If sold or agreed to be sold, the purchase price of each item in the currency of the sale,

- If the merchandise is shipped for consignment, the value of each item in the currency in which the transactions are usually made, or, in the absence of such value, the price in such currency that the manufacturer, seller, shipper, or owner would have received, or was willing to receive, for such merchandise if sold in the ordinary course of trade and in the usual wholesale quantities in the country of exportation

- The kind of currency,

- All charges upon the merchandise, itemized by name and amount including freight, insurance, commission, cases, containers, coverings, and cost of packing; and, if not included above, all charges, costs, and expenses incurred in bringing the merchandise from alongside the carrier at the port of exportation in the country of exportation and placing it alongside the carrier at the first U.S. port of entry. The cost of packing, cases, containers, and inland freight to the port of exportation need not be itemized by amount if included in the invoice price and so identified. Where the required information does not appear on the invoice as originally prepared, it shall be shown on an attachment to the invoice,

- All rebates, drawbacks, and bounties, separately itemized, allowed upon the exportation of the merchandise,

- The country of origin,

- All goods or services furnished for the production of the merchandise not included in the invoice price.

Additional Requirements for Commercial Invoice

If the merchandise on the documents is sold while in transit, the original invoice reflecting this transaction and the resale invoice or a statement of sale showing the price paid for each item by the purchaser shall be filed as part of the entry, entry summary, or withdrawal documentation

The invoice and all attachments must be in the English language, or shall be accompanied by an accurate English translation.

Each invoice shall state in adequate detail what merchandise is contained in each individual package.

If the invoice or entry does not disclose the weight, gauge, or measure of the merchandise necessary to ascertain duties, the importer of record shall pay expenses incurred to obtain this information prior to the release of the merchandise from CBP custody.

Each invoice shall set forth in detail, for each class or kind of merchandise, every discount from the list or other base price that has been or may be allowed in fixing each purchase price or value.

Pro-Forma Invoice

Pro Forma Invoice If the required commercial invoice is not filed at the time the merchandise is entered, a statement in the form of an invoice (a pro forma invoice) must be filed by the importer at the time of entry.

A bond is given for production of the required invoice not later than 120 days from the date of the entry summary, or entry if there is no entry summary.

If the invoice is needed for statistical purposes, it must generally be produced within 50 days from the date on which the entry summary is required to be filed. The exporter should bear in mind that unless he or she forwards the required invoice in time, the American importer will incur a liability under his bond for failure to file the invoice with the port director of CBP before the 120-day period expires.

Although a pro forma invoice is not prepared by the exporter, it is of interest to exporters as it gives a general idea of the kind of information needed for entry purposes. A pro forma invoice indicates what the importer may find necessary to furnish CBP officers at the time a formal entry is filed for a commercial shipment, if a properly prepared CBP or commercial invoice is not available at the time the goods are entered.

An acceptable format for a pro forma invoice is reproduced in the appendix. Some of the additional information specified for the commodities under section 141.89 of the CBP Regulations may not be required when entry is made on a pro forma invoice.

However, the pro forma invoice must contain sufficient data for examination, classification, and appraisement purposes