How do you Import goods & Products from Turkey To United States?

If you want to import from a foreign country, there are some requirements and documentations you need to provide in order to import or export goods.

Entry of Goods

- Entry Process

- Import Documentations

- Right To Make Entry

- Examination of Goods and Entry Documents

- Packing of Goods—Commingling

Import Licenses

An importer needs only a tax number to import all but restricted items, which include firearms, hazardous materials, and other products that may be imported by authorized establishments only or for which approval from relevant Turkish government agencies are required. Control Certificates are required only for animals, animal products, and certain plants such as seeds, seedlings, saplings and flower bulbs.

Import Documentation

Turkish documentation procedures require that a commercial invoice and bill of lading or airway bill accompany all commercial shipments. Depending on the type of product, importers may be required to submit a Certificate of Origin.

Import licenses and phytosanitary certificates are necessary for food and agricultural commodity imports.

Conformity Compliance (CE Mark)

Companies selling to the Turkish market must submit evidence of conformity compliance (CE Mark) either by providing a conformity certificate from a notified body or a manufacturer-issued declaration of conformity, which declares compliance with all relevant standards and directive annexes.

The declaration of conformity must mention the applicable directive(s), the name of the manufacturer or its authorized representative, the name of the notified body (if involved), product information and reference to harmonized standards. If the notified body is also involved in the process, the type of examination certificate should also be submitted.

The technical file is a dossier, which includes a user manual, product specifications, technical drawings and standards applied per the appropriate directives and corresponding annexes. Although it may not be enforced by the Turkish government for every imported product with a CE marking, manufacturers are assumed to have prepared a technical file.

Several U.S. companies have reported difficulties when submitting a technical file after their products were shipped to Turkey. Other companies have had intellectual property rights (IPR)-related concerns and have been reluctant to provide drawings or in-depth information about the technical specifications of their product(s). In order to avoid customs delays, the importer should be knowledgeable about relevant procedures and required documentation.

Commercial Invoice

The commercial invoice must be submitted in triplicate, including the original copy and must contain a complete description, quantity, unit cost, HS code, delivery method of the goods and country of origin as well as all required payment terms and letters of credit, if the transaction was actualized through this payment method.

Read our complete Commercial Invoice Instruction to make a perfect commercial invoice.

Certificate of Origin

A Certificate of Origin is required by certain foreign countries for tariff purposes, certifying the country of origin of specified goods. The certificate of origin is to be prepared in duplicate. No corrections are permitted on this document, and it should be in English.

A Certificate of Origin is usually prepared by the exporter or the freight forwarder and notarized and attested to by a local Chamber of Commerce or a World Trade Center. The Turkish Embassy or Consulate in the United States must certify the Certificate of Origin. One copy of the document must be surrendered to customs authorities at the time of importation.

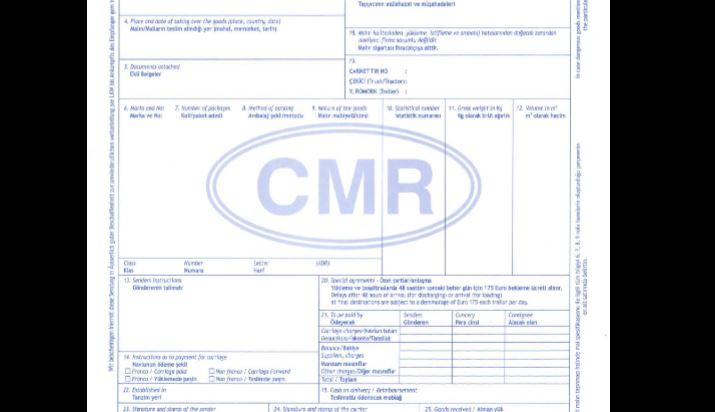

Bill of Lading/Airway Bill

Details in the bill of lading should correspond exactly to those given in other shipping documents. The original bill of lading should be submitted along with three copies.

Proforma Invoices

The pro forma invoice must not be more than six months old at the time of application. The words “pro forma” must be included on the document. It must contain an unexpired option (if appropriate), indicate freight and insurance charges separately, and bear the importer’s name as well as the description, unit price, quantity and delivery/payment method of specified goods. Products falling under the EU New Approach Directives must be accompanied by either a self-declaration of conformity or a notified body’s issued certificate of conformity to be allowed entry into the Turkish market. See the Standards and CE Mark section below.

Health Certification

Special health certificates are required for imports of plants, seeds, live animals and animal products. Plants, including fruits and vegetables, must be substantially free from pests and diseases and must have been grown in an area substantially free from prohibited pests and diseases.

Additional information may be obtained from the U.S. Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS). APHIS inspects and certifies that plants, plant products and live animals and animal products conform to health and sanitary/ phytosanitary requirements as required by Turkish regulations.

U.S. exporters are encouraged to obtain information from the importer prior to shipment because of the complexity of sanitary and phytosanitary regulations.

Special Import Requirements

Alcohol can be imported by the private sector by obtaining license and permission from the Tobacco Products and Alcoholic Drinks Market Regulatory Authority (TAPDK), an independent regulatory body.

Inspection of imported products is regulated by the Communique on Import Inspection of Tobacco, Tobacco Products, Alcohol and Alcoholic Beverages (Regulation on Product Safety and Inspection: 2018/19). Nevertheless, non-tariff barriers, arduous documentation requirements, and high duty rates continue to limit trade in alcoholic beverages.

Cigarettes can only be imported by cigarette producers, which are granted permission by the government under special decree.

Importation of Precious Metals/Stones

Precious metals (e.g., gold and platinum) may only be imported by members of the Istanbul Precious Metals Exchange operating under Borsa Istanbul (Istanbul Stock Exchange). The Istanbul Stock Exchange consists of domestic or foreign banks, precious metals companies, currency offices, precious metals producing and marketing companies and precious metals refineries.

Turkey officially became a member in 2007 of the Kimberley Process Certification Scheme, the joint government, international diamond industry and civil society initiative to stem the flow of conflict diamonds.

Risk-Based Trade Control System (TAREKS)

The Ministry of Trade launched a Risk-Based Control System (TAREKS)” in 2010 to carry out safety and quality checks on exported and imported goods electronically and on a risk basis. Designed to be accessible online using an e-signature, the main purpose of this control system is to increase the efficiency of foreign trade, to provide safe and quality products to consumers and firms by controlling the entry of “risky” products and traders to the market and to reduce waiting times at customs.

TAREKS encompasses goods like toys, medical devices, telecommunication products, personal protective equipment, machinery, electrical equipment, gas appliances, and some industrial raw materials and agricultural products.

Ports Of Entry

Ports of entry conduct the daily, port-specific operations like clearing cargo, collecting duties and other monies associated with imports, and processing passengers arriving from abroad.

Port personnel are the face at the border for nearly all cargo carriers and people entering the United States. Ports of entry are the level at which CBP enforces import and export laws and regulations and implements immigration policies and programs.

Port officers also perform agricultural inspections to protect the USA from potential carriers of animal and plant pests or diseases that could cause serious damage to America’s crops, livestock, pets, and the environment.