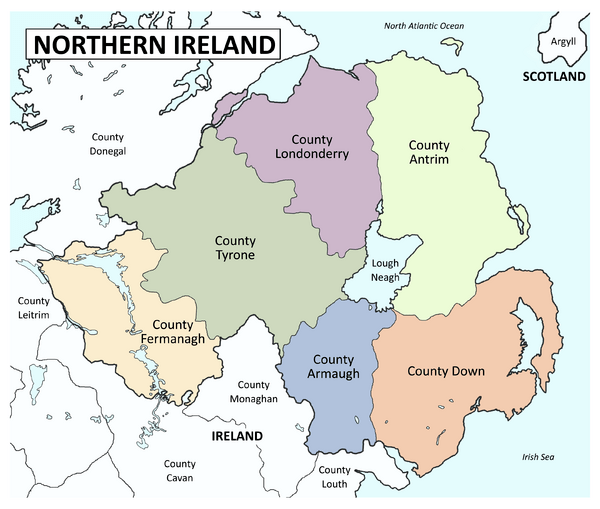

Economy of Northern Ireland, UK

Northern Ireland’s economy is closely bound to that of the rest of the United Kingdom. Although historically the economic links between Northern Ireland and its closest neighbour, the republic of Ireland, were remarkably underdeveloped, trade between the two has grown substantially.

Compared with the rest of the United Kingdom, the economy of Northern Ireland has long suffered, largely a result of political and social turmoil. To spur economic development, in the 1980s the British and Irish governments created the International Fund for Ireland, which disburses economic assistance to the entire island, with significant resources going to Northern Ireland.

Northern Ireland also receives economic assistance from the European Union.

NI Economic output increased over the quarter and the year.

The NICEI indicates that economic output increased by 3.1% over the quarter to June 2021. Meanwhile economic output in the year to June 2021 increased by 22.2% in real terms compared to the same period in the previous year i.e. Quarter 2 2020.

Economic Growth of Northern Ireland in 2021

Northern Ireland has the smallest economy of any of the twelve NUTS 1 regions of the United Kingdom, at £27.4bn . However, this is partly because Northern Ireland has the smallest population; at £15,200 Northern Ireland has a greater GDP per capita than both North East England and Wales.

Rural areas including the North West are particularly deprived. It suffers from the highest unemployment and highest poverty rates in Northern Ireland.

Throughout the 1990s, the Northern Irish economy grew faster than the rest of the UK, due in part to the rapid growth of the economy of the Republic of Ireland and the so-called “peace dividend”. An April 2007 survey found Northern Ireland’s average house price to one of the highest in the UK, behind London, the South East and the South West. It also found Northern Ireland to have all of the top ten property “hot spots”, with the Craigavon and Newtownards areas increasing by 55%.

However, as of 2018 Northern Ireland house prices are the lowest on average in the UK approx 40% lower than before the bubble burst in 2008

Projected Economic Growth of Northern Ireland in 2022

Northern Ireland GDP is projected to grow by 5.9% this year following a fall of 10.1% in 2020. The recovery is expected to continue into 2022 with growth of 4.1% projected.

Employment Statistics of Northern Ireland in 2021

- The number of employee jobs in June 2021 was estimated at 771,680. This was an increase of 1,190 jobs (+0.2%) over the quarter and a decrease of 4,860 jobs (-0.6%) over the year. Neither the quarterly nor the annual changes in employee jobs were found to be statistically significant.

- June 2021 marked the second consecutive quarterly increase in employee jobs, following four previous quarters of decline. The first annual decline in employee jobs since 2012 was noted in September 2020 and since then there have been four consecutive quarters of annual decline.

- The annualised growth rate of total employee jobs has fallen every quarter between March 2018 (+2.3%) and June 2021 (-1.0%). June 2021 marked the third consecutive quarter of negative annualised growth.

- In the last five years, employee jobs have increased by 5.0% (+37,090 jobs). There has been an increase of 11.6% (+80,520 jobs) from the low in March 2012.

- Quarterly increases in employee jobs were seen within the services (+1,360 jobs), manufacturing (+310 jobs) and other industries (+40 jobs) sectors to June 2021. The construction sector reported a decrease over the quarter (-520 jobs).

- All four broad industry sectors experienced decreases in employee jobs over the year to June 2021, with the services sector reporting the biggest annual decline (-2,910 jobs).

- Private sector jobs increased marginally over the quarter (+0.1% or +740 jobs) but decreased over the year (-1.1% or -6,310 jobs) to 556,820 jobs in June 2021. Public sector jobs increased over both the quarter (+0.3% or +580 jobs) and the year (+0.6% or +1,250 jobs) to 214,710 jobs in June 2021.

Investments to Northern Ireland

Foreign direct investment was restrained by The Troubles. Since the signing of the Good Friday Agreement, investment in Northern Ireland has increased significantly.Most investment has been focused in Greater Belfast and to a lesser extent Greater Derry. Major projects include the Victoria Square Shopping Centre Belfast City Centre.

Titanic Quarter is a waterfront development under construction. The Laganside Corporation was previously at the forefront of the redevelopment along the banks of the River Lagan. The Cathedral Quarter has also seen substantial investment. In Derry, the ILEX Urban Regeneration Company no longer exists. The area is 12th in terms of funding despite it being the second city.

Manufacturing and Production in Northern Ireland

Heavy industry is concentrated in and around Belfast, although other major towns and cities also have heavy manufacturing areas. Machinery and equipment manufacturing, food processing, textile and electronics manufacturing are the leading industries. Other industries such as papermaking, furniture manufacturing, aerospace and shipbuilding are also important, concentrated mostly in the eastern parts of Northern Ireland.

Although its share of economic output has declined, manufacturing output in Northern Ireland has remained almost unchanged over the past five years, after a period of steep manufacturing growth between 1998 and 2001. However, this overall picture of health hides a shift in manufacturing priorities, with the decline of traditional industries, such as textiles and shipbuilding, at the expense of high tech and capital-intensive industries. In 2005, chemicals and engineering were the only two manufacturing sub-sectors to record growth, whilst output of textiles fell by 18%.

Engineering is the largest manufacturing sub-sector in Northern Ireland, particularly in the fields of aerospace and heavy machinery. Spirit Aerosystems is the province’s largest industrial employer, with 5,400 workers at five sites in the Greater Belfast area. Other major engineering employers in Northern Ireland include Caterpillar, Emerson Electric, Fujitsu, Allstate NI, Seagate and NACCO. Many of these enjoy close academic and business links with Queen’s University Belfast and Ulster University. The former ranks as one of the best British universities for all engineering courses.

Harland and Wolff, which in the early 20th century was the world’s biggest shipbuilder, suffered from intense international competition during the 1970s and 1980s and declined rapidly. During the 1990s the company diversified into civil engineering and industrial fabrication, manufacturing bridges and oil platforms. The vast works on Queen’s Island were downsized, with much of the land (including the slipway where RMS Titanic was built) sold off for redevelopment in the 2000s as the Titanic Quarter. The modern, smaller yard employs only 800 people. H&W has not built a ship since 2003, but has seen workload increase through shipbreaking, ship repair and maintenance and conversion work. The company has also been active in the design and construction of offshore power generation equipment- both wind turbines and wave-action turbines.

Latest News from Northern Ireland 2022

The Northern Ireland Statistics and Research Agency (Nisra) said employee numbers hit its highest record in July at 762,000.

It is the second month in a row numbers surpassed March 2020 pre-Covid levels.

HM Revenue and Customs payroll data is the most timely and best single overall indicator of the labour market.

The figures showed an estimated 762,600 employees in July – that is 1.3% higher than March 2020 and 3.1% higher than the same time last year.

It includes furloughed employees, who numbered about 44,000 at the end of June.