What is a Certificate of Insurance in Import & Export?

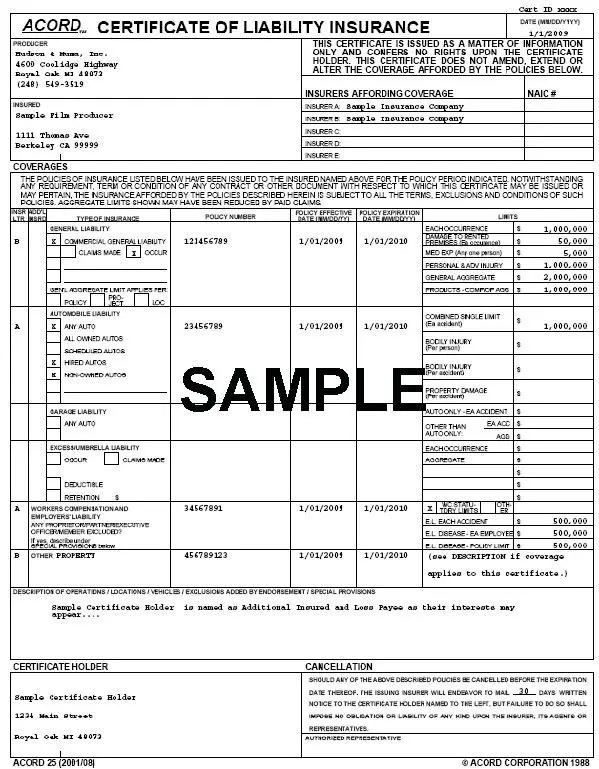

A Certificate of Insurance is provided by the insurance company for your shipments. This document mentions the insurance policy that is being bought for the shipment and includes all the key details as to the coverage of the insurance. Typically, the Certificate of Insurance is not a negotiable document and it also cannot be assigned to a third party.

On the other hand, due to the nature of the Certificate of Insurance, it cannot be used in making claims and also

under the terms of a letter of credit (L/C). A Certificate of Insurance merely shows that there is insurance coverage for the named shipment and for the purpose of setting out terms as well as claims, the full insurance policy is still needed.

In some cases a shipper may issue a document that certifies that a shipment has been insured under a given open policy, and that the certificate represents and takes the place of such open policy, the provisions of which are controlling. Because of the objections that an instrument of this kind did not constitute a “policy” within the requirements of letters of credit, it has become the practice to use an insurance certificate. Also called cargo insurance certificate and special cargo policy. See open marine cargo insurance policy; open policy.

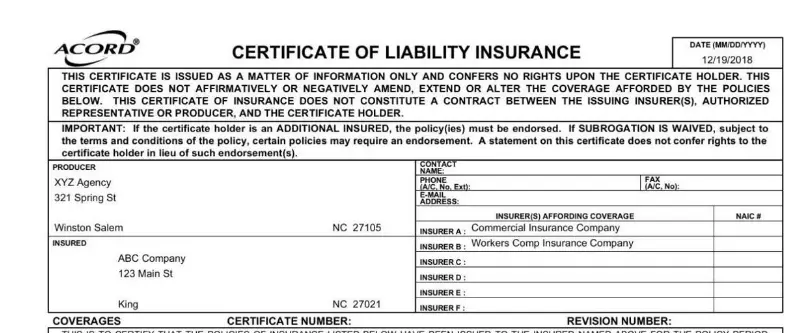

Certificate of Insurance Template

Certificates of Insurance cover the importer/exporter for any possible damage to the goods while in transit

Your broker or freight forwarder can arrange insurance for your shipment.

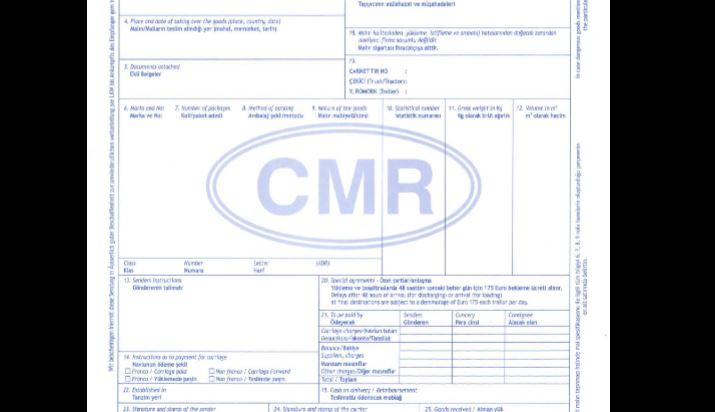

What am I responsible for?

The International Chamber of Commerce (ICC) outlines the duties and responsibilities of the buyer and seller.

These all called Incoterms (International Commercial Terms), and outline where the exporter’s responsibility ends and the importer’s begins.

ICC lists a series of commonly used incoterms in international transactions.

Cargo insurance certificate

A document indicating the type and amount of insurance coverage in force on a particular shipment. Used to assure the consignee that insurance is provided to cover loss of or damage to the cargo while in transit. In some cases a shipper may issue a document that certified that a shipment has been insured under a given open policy, and that the certificate represents and takes the place of such open policy, the provisions of which are controlling.

Because of the objections that an instrument of this kind did not constitute a “policy” within the requirement of letters of credit, it has become the practice to use a special marine policy.

A special marine policy makes no difference to an open policy and stands on its own feet as an obligation of the underwriting company. Also called insurance certificate and special cargo policy. See bordereau; open policy; special marine policy.