Documents Required for International Shipping

There are many documents involved in international trade, such as commercial documents, financial documents, transport documents, insurance documents and other international trade related documents.

In processing the export consignment, documentation may be executed in up to four contracts: the export sales contract, the contract of carriage, the contract of finance and the contract of cargo insurance.

It is therefore important to understand the role of each document and its requirements in international trade.

List of Documents required for Exports Customs Clearance

- ProForma Invoice

- Customs Packing List

- Country of Origin or COO Certificate

- Commercial Invoice

- Shipping Bill

- Bill of Lading or Airway Bill

- Bill of Sight

- Letter of Credit

- Bill of Exchange

- Export License

- Warehouse Receipt

- Health Certificates

List of Documents required for Imports Customs Clearance

- Bill of Entry

- Commercial Invoice

- Bill of Lading or Airway Bill

- Import License

- Certificate of Insurance

- Letter of Credit or LC

- Technical Write-up or Literature (Only required for specific goods)

- Industrial License (for specific goods)

- Test Report (If any)

- RCMC Registration cum Membership Certificate

- GATT/DGFT declaration

- DEEC/DEPB/ECGC License for duty benefits

Pro Forma Invoice

A pro forma invoice is an important document used as a negotiating tool between the seller and the buyer prior to an export shipment. This document should be used by the seller to quote at the beginning of an export transaction and it will eventually become the final commercial invoice used when goods are cleared through customs in the importing country. The document contains a description of goods (e.g., quantity, price, weight, kind and other specifications) and is a declaration by the seller to provide the products and services to the buyer at the specified date and price.

Commercial Invoice

The commercial invoice is a legal document between the exporter and the buyer (in this case, the foreign buyer) that clearly states the goods being sold and the amount the customer is to pay. The commercial invoice is one of the main documents used by customs in determining customs duties. A commercial invoice is a bill for the goods from the seller to the buyer. These documents are often used by governments to determine the true value of goods when assessing customs duties. Governments that use the commercial invoice to control imports will often specify its form, content, number of copies, language to be used and other characteristics.

Packing List

Considerably more detailed and informative than a standard domestic packing list, an export packing list lists seller, buyer, shipper, invoice number, date of shipment, mode of transport, carrier, and itemizes quantity, description, the type of package, such as a box, crate, drum, or carton, the quantity of packages, total net and gross weight (in kilograms), package marks and dimensions, if appropriate. Both commercial stationers and freight forwarders carry packing list forms. A packing list may serve as conforming document. It is not a substitute for a commercial invoice. In addition, U.S. and foreign customs officials may use the packing list to check the cargo so the commercial invoice should reflect the information shown on the packing list.

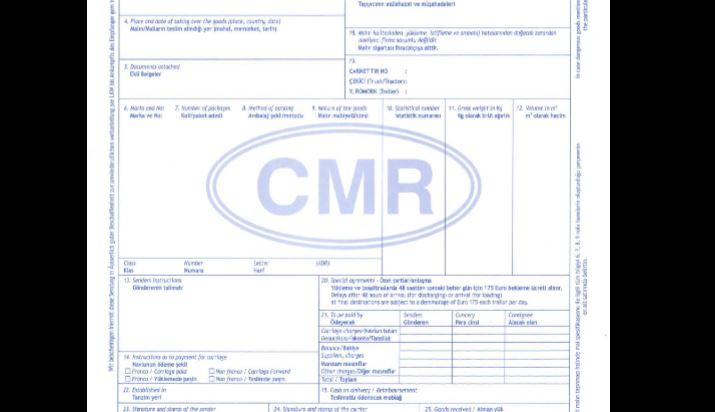

Transportation Documents

Air Waybill

Air freight shipments require airway bills. An air way bill accompanies goods shipped by an international air carrier. The document provides detailed information about the shipment and allows it to be tracked. Air waybills are shipper-specific and are not negotiable documents (as opposed to “order” bills of lading used for vessel shipments).

Bill of Lading

A bill of lading is a contract between the owner of the goods and the carrier (as with domestic shipments). For ocean shipments, there are two common types: a straight bill of lading, which is non-negotiable, and a negotiable, or shipper’s order bill of lading. The latter can be used to buy, sell or trade the goods while in transit. The customer usually needs an original bill of lading as proof of ownership to take possession of the goods from the ocean carrier.

Country of Origin or COO Certificate

The Country of Origin Certificate is a declaration issued by the exporter that certifies that the goods being shipped have been completely acquired, produced, manufactured or processed in a particular country.

Letter of Credit

Letter of credit is shared by the importer’s bank, stating that the importer will honour payment to the exporter of the sum specified to complete the transaction.

Depending on the terms of payment between the exporter and importer, the order is dispatched only after the exporter has this letter of credit.

Bill of Exchange

Bill of Exchange is an alternative payment option where the importer is to clear payments for goods received from the exporter either on-demand or at a fixed or determinable future.

It is similar to promissory notes that can be drawn by banks or individuals. You can even transfer a Bill of Exchange by endorsement.

Export License

Businesses must have an export license that they can provide to customs in order to export or forward any products. This only needs to be produced when the shipper is exporting goods to an international destination for the very first time. This type of license may vary depending on the type of export you intend to make.

This can be done by applying with the licensing authority, and the permit is eventually issued by the Chief Controller of Exports and Imports.

Warehouse Receipt

Warehouse Receipt receipt is generated once the exporter has cleared all relevant export duties and freight charges post customs clearance. This is needed only when an ICD in involved.

Health Certificates

Health Certificate is applicable only when there are food products that are of animal or non-animal origin involved in international trade.

The document certifies that the food contained in the shipment is fit for consumption by humans and has been vetted to meet all standards of safety, rules and regulations prior to exporting. This certificate is issued by authorised governmental organisations from where the shipment originates.

Bill of Entry

A bill of entry is a legal document to be filled & duly signed by an importer/CHA/carrier. After filing a bill of entry along with the other necessary documents, assessment and examination of goods are carried out by concerned authorities. Once the process is completed, an importer can avail for ITC claim on goods.

Import License

There are certain items that cannot be freely imported in India, an import license is a permission granted by the government to undertake import activities for restricted goods. In order to avail the benefits, one must file an application to the licensing authority.

Insurance certificate

An Insurance Certificate is a document required for import customs clearance. This certificate helps the authorities to verify the shipment, in terms of whether the selling price contains the insurance or not. Also, it helps determine the precise value which eventually decides the import duty aggregate.

Start export business from india in a simple and easy way with Amazon Global Selling. Understand the various steps involved in exporting products from India to the world and start selling.