What is a Letters of Credit?

Letters of credit are a payment method used for the sale of goods between exporters and importers.

A letter of credit is an undertaking given by a bank that they will pay the exporter. The exporter must fulfil all of the terms and conditions of the letter of credit to ensure the issuing bank will pay.

The Advantages of a Letter of Credit

Letters of credit (LCs) are one of the most versatile and secure instruments available to international traders. An LC is a commitment by a bank on behalf of the importer (foreign buyer) that payment will be made to the beneficiary (exporter) provided that the terms and conditions stated in the LC have been met, as evidenced by the presentation of specified documents.

Since LCs are credit instruments, the importer’s credit with their bank is used to obtain an LC. The importer pays the bank a fee to render this service.

An LC is useful when reliable credit information about a foreign buyer is difficult to obtain or if the foreign buyer’s credit is unacceptable, but the exporter is satisfied with the creditworthiness of the importer’s bank.

The Letter of Credit Process

There are typically seven steps that occur in order to get paid using a letter of credit:

- The importer arranges for the issuing bank to open an LC in favor of the exporter.

- The issuing bank transmits the LC to the nominated bank, which forwards it to the exporter.

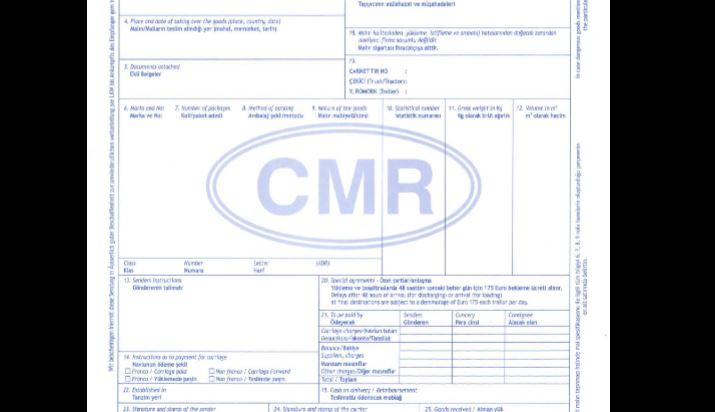

- The exporter forwards the goods and documents to a freight forwarder.

- The freight forwarder dispatches the goods and either the dispatcher or the exporter submits documents to the nominated bank.

- The nominated bank checks documents for compliance with the LC and collects payments from the issuing bank for the exporter.

- The importer’s account at the issuing bank is debited.

- The issuing bank releases documents to the importer to claim the goods from the carrier and to clear them at customs.

Why use a Letter of Credit in International Trade Transactions

Seller Concerns:

- Contract risk: Having a well-crafted sales agreement with proper terms of sale and payment.

- Production risk: What if the buyer cancels the order?

- Legal risk: What are the foreign laws and jurisdiction in case of disputes and/or defaults?

- Currency Risk: Doing business in hard currency. i.e. currency widely accepted around the world as a form of payment for goods and services.

- Export regulations.

- Risk of misunderstanding: Using terms of sale and payment terms that has common interpretation in the buyer’s and seller’s countries.

- Title Retention: Risk of losing title to goods in a foreign country.

- Insolvency risk: What if the buyer goes bankrupt? Knowing the credit worthiness of the buyer.

- Control on logistics of shipping the goods.

- Control on transfer of risk from seller to buyer during transit of goods.

- Risk of non-acceptance: Goods may not be accepted by the buyer upon arrival in buyer’s country.

- Payment Risk: Payment may not be made on time or as per terms of the sale.

- Country Risk: The risk factors associated with the country of import: Geographical, Economic and Political.

- Financing: Opportunity of getting financed for the job.

Buyer Concerns:

- Contract risk: Having a well-crafted sales agreement with proper terms of sale and payment. Accurate description of goods; pricing; invoicing; origin etc.

- Import Regulations.

- If pre-paid, what if the seller takes the money and does not ship?

- What if the seller sends substandard goods or goods not as per description in the contract?

- Legal risk: Knowing the local laws and jurisdiction in case of disputes and/or defaults.

- Risk of misunderstanding: Using terms of sale and payment terms that has common interpretation in the buyer’s and seller’s countries.

- Control on the timing for shipment of goods.

- Control on logistics of shipping the goods.

- Control on transfer of risk from buyer to seller during transit of goods.

- Negotiating credit terms from the seller for payment: Net 30, Net 60 etc.

See our article Commonly Used Export And Import Documents In 2022 for more information.