What is Certificate of Origin or Country of Origin (COO) ?

The Country of Origin Certificate is a declaration issued by the exporter that certifies that the goods being shipped have been completely acquired, produced, manufactured or processed in a particular country.

It establishes the country of origin of the product, which is particularly important for an exporter claiming import duty benefits against the product(s). It is often in the form of a statement attached to the commercial invoice, or a separate declaration, which gives a line item-wise list of the origin of all products.

A COO is signed by the exporter (or an authorized representative) and certified to be true and correct.

Importance of Country of Origin in Import

The country of origin is a vital element in the import process as it is used for determining and regulating duty rates, preferential trade agreements, trade sanctions, and import quotas. The US Customs & Border Protection (CBP) is vigilant about verifying the country of origin because there are revenue and admissibility issues involved with every import shipment.

The country of origin is also required for marking purposes. The import regulations require the end-user to be informed about the country of origin of the articles imported.

Labelling requirements

The requirements for Country of Origin markings are complicated by the various designations which may be required such as “Made in X”, “Product of X”, “Manufactured in X” etc. They also vary by country of import and export. For example:

- For imports to the United Kingdom, there is a voluntary code for Food. Other products are not subject to labelling requirements, but misleading labelling can result in prosecution under the Trade Descriptions Act 1968.

- Food exported to the United Arab Emirates must include Country of Origin

International Trade

When shipping products from one country to another, the products may have to be marked with country of origin, and the country of origin will generally be required to be indicated in the export/import documents and governmental submissions. Country of origin will affect its admissibility, the rate of duty, its entitlement to special duty or trade preference programs, antidumping, and government procurement.

Today, many products are an outcome of a large number of parts and pieces that come from many different countries, and that may then be assembled together in a third country. In these cases, it’s hard to know exactly what is the country of origin, and different rules apply as to how to determine their “correct” country of origin. Generally, articles only change their country of origin if the work or material added to an article in the second country constitutes a substantial transformation, or, the article changes its name, tariff code, character or use (for instance from wheel to car). Value added in the second country may also be an issue.

In principle, the substantial transformation of a product is intended as a change in the harmonized system coding. For example, a rough commodity sold from country A to country B, than subjected of a transformation in country B, which sells the final processed commodity to a country C is considered a sufficient step to label the end product made in B.

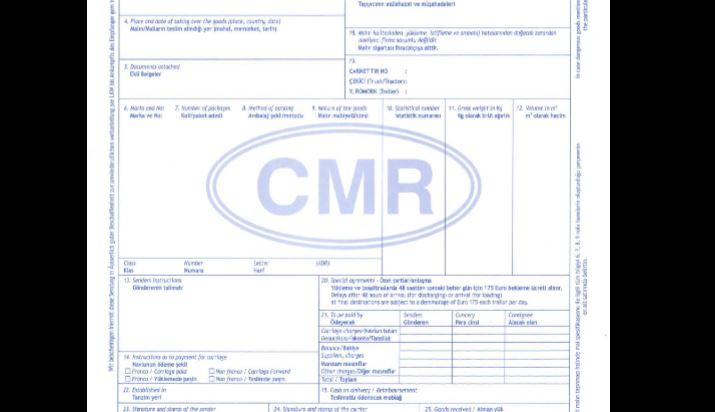

Two Varieties of Certificates

According to International Chamber of Commerce World Chambers Federation, there are two varieties of certificates.

Non-Preferential CO

The main type issued by chambers is a “Non-Preferential CO.” For example, an “ordinary CO,” which certifies the country of origin of a particular product, does not qualify for any preferential treatment.

Preferential CO

The second type is Preferential COs,” which enable products to benefit from a tariff reduction or exemption when they are exported to countries extending these privileges.

An example of this is NAFTA. The NAFTA Certificate of Origin is used by the United States, Canada, and Mexico to determine if imported goods are eligible to receive reduced or eliminated duty as specified by the NAFTA.

According to the United States Trade Representative site,

“The Certificate of Origin must be completed and signed by the exporter of the goods. Where the exporter is not the producer, the exporter may complete the Certificate on the basis of knowledge that the good originates; reasonable reliance on the producer’s written representation that the good originates; or, a completed and signed Certificate of Origin for the good voluntarily provided to the exporter by the producer.”

Country of Origin Certificates may be needed to comply with the terms and conditions of a Letter of Credit, fulfill a buyer’s request or satisfy a foreign customs requirement and is most often accompanied by an invoice.

Prior to moving goods, check with an international transportation company to determine whether you need a certificate of origin (typically based on a certain shipment value) to accompany a standard invoice on an international shipment. The bigger global transport companies usually allow you to download a form online (once the shipment takes place, there is a nominal processing fee) and will assist in making sure the form is completed accurately.

Note: Should you make an incorrect origin declaration or misrepresent the country of origin (too vague or deliberately confusing), the shipment may be refused, confiscated at the border, assessed a penalty fee or subject to a rigorous compliance program. And you surely don’t want that to happen, so err on the side of being overly cautious here!