The Impact of COVID-19 on International Shipping and Trade

2020 marked some of the largest reductions in trade and output volumes since WWII.

Focusing on the COVID-19 pandemic and using the latest monthly and quarterly data on international trade of selected countries and products, this paper documents key shifts in geographical direction and product composition of international trade in 2020.

Trade in services declined by more than twice as much as trade in goods and its recovery has also been slower. While the size of the drop in global trade relative to the drop in output in 2020 was smaller than during the Global Financial Crisis (GFC), this was not related to the overall size of the trade impacts in 2020, but rather reflects the significant heterogeneity of trade and production impacts across specific goods, services and trade partners from COVID-19.

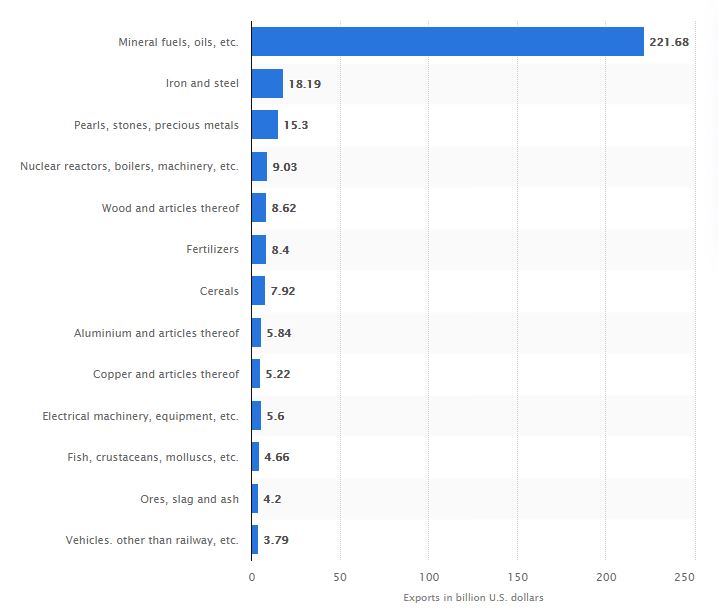

Trade in several types of goods plummeted, while that in others increased markedly. As a result, the variation in trade impacts across the different product categories in 2020 was not only larger than during the GFC, but also larger than in any other year during the past two decades. The product structure of countries’ goods trade also changed significantly in 2020, indicating large adjustments.

While some international supply chains came under pressure in early months of the pandemic, the data also show that supply chains were instrumental in the resumption of economic activity.

The distance travelled by imported products actually continued to increase in 2020, largely as a result of China and other Asian countries filling supply gaps resulting from lockdowns and demand changes in other regions.

Understand the implications of coronavirus in freight shipping

The coronavirus outbreak has implications in container shipping flows and global supply chains. The inability of Chinese manufacturing facilities to reopen after Chinese New Year festivities has created an shortfall in global Chinese exports and a resulting drop in container volumes, starting first with European and American trade routes.

Through a series of domino effects, Covid-19 has had repercussions on the shipping industry way beyond China. Logistics throughout the world now are facing reduced available capacity, pressure on equipment availability, possible congestion in specific ports and extra related costs and congestion surcharges.

What does the future hold for the shipping industry?

In these uncertain times, it is difficult to make a forecast even for the next few months. The coronavirus pandemic will have a long-term impact on the global shipping industry, and we will continue to adapt to changes. However, there are a few things that you as a shipper can expect going forward in 2022.

Shipping costs have increased significantly

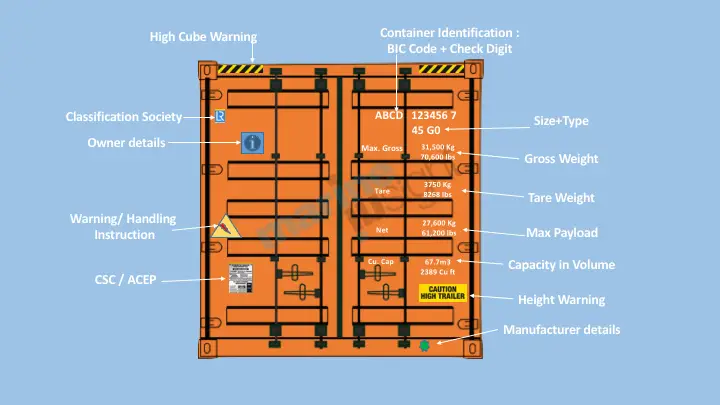

Imbalances in regional trade brought about by the pandemic have contributed to the rise in shipping costs. In particular, increased demand for durable goods in locked-down economies, combined with Covid-related disruption in the ports of those countries, exacerbated the shortage of shipping containers. Containers became ‘stuck’ in the US and Europe rather than returned to Asia.

The shortage of shipping containers is likely to be temporary and ultimately fade. However, shipping costs could remain elevated in the near future, supported by the strength in manufacturing and the recent commodities boom, partly driven by the recovery in economic outlook across the globe.