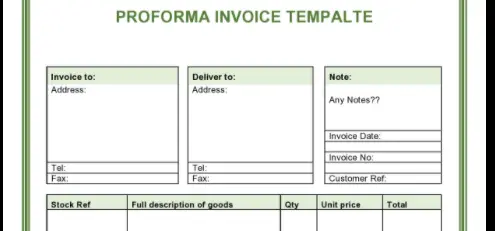

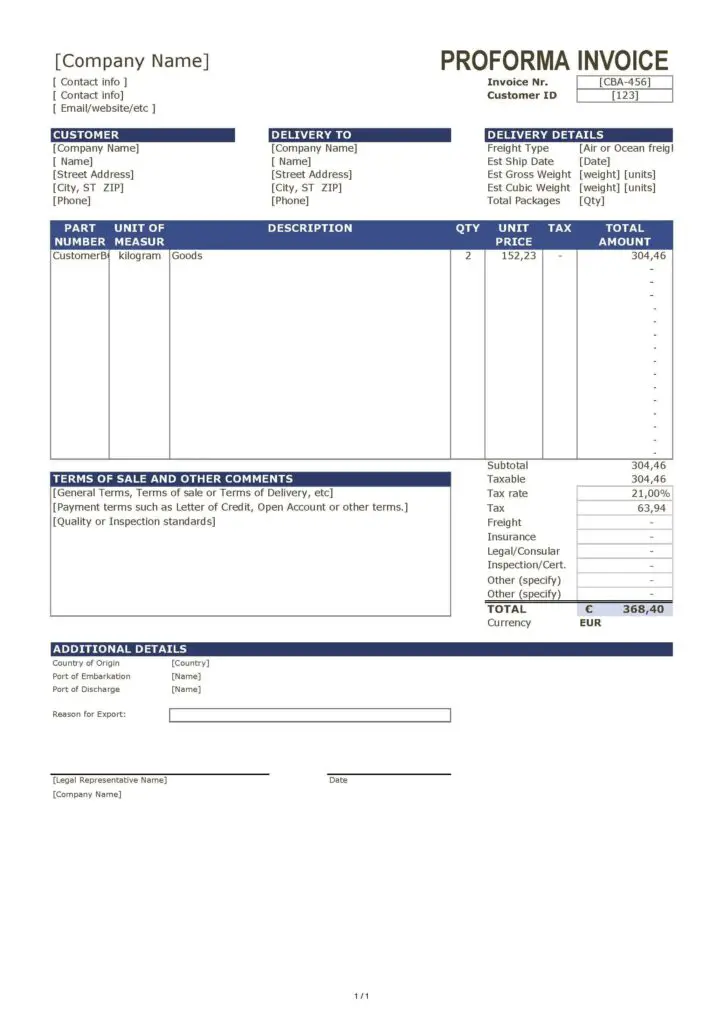

Pro Forma Invoice Instructions

1. Seller’s name and address

2. Buyer’s name and address

3. Buyer’s reference

4. Items quoted

5. Prices of items: per unit and extended totals

6. Weights and dimensions of quoted products

7. Discounts, if applicable

8. Terms of sale or Incoterm used (include delivery point)

9. Terms of payment

10. Estimated shipping date

11. Validity date

What is a Pro Forma Invoice?

A pro forma invoice is a quote in an invoice format that may be required by the buyer to apply for an import license, contract for pre-shipment inspection, open a letter of credit or arrange for transfer of hard currency.

A pro forma may not be a required shipping document, but it can provide detailed information that buyers need in order to legally import the product.

KEY TAKEAWAYS

- Pro forma invoices are sent to buyers ahead of a shipment or delivery of goods or services.

- Most pro forma invoices provide the buyer with a precise sale price.

- No guidelines dictate the exact presentation or format of a pro forma invoice

- A pro forma invoice requires only enough information to allow customs to determine the duties needed from a general examination of the included goods.

Difference Between Pro Forma Invoice & Commercial Invoice

- A pro forma invoice is a speculation, a best guess about the cost of an order before it’s been filled. Pro forma invoices are commonly used for importing and exporting, especially when the buyer and the seller don’t have a history of working together.

- A commercial invoice reflects a real situation, showing prices and quantities for what has actually been sold. The documents may look essentially the same, but the pro forma version reflects a situation that isn’t necessarily real, though it does reflect a vendor’s best guess as to what the final commercial invoice will include.

When to Use a Pro Forma Invoice

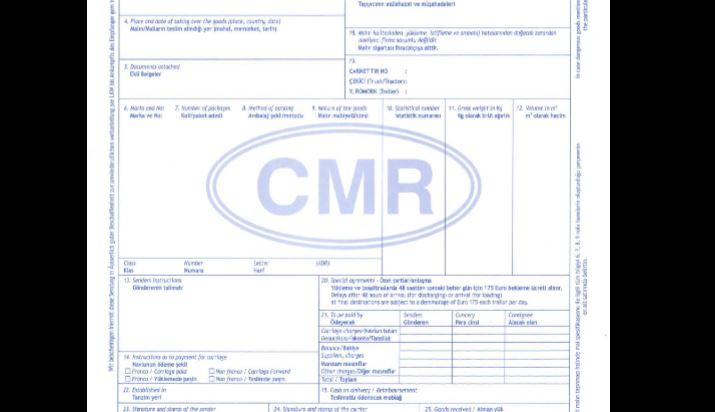

Use a pro forma invoice to create a potential sale and an invoice to confirm that one has been executed. Sometimes it is necessary to create a provisional bill of sale before your product or services have been delivered, with a precise price quote, shipping cost, and taxes. Pro forma invoices are often used when shipping items internationally because they provide all the detail that is needed for the shipment to clear customs before delivery.

Once your products or services have been received, you can easily modify your pro forma to create a final invoice.

Format of Pro Forma and Commercial Invoices

A pro forma invoice may look almost exactly the same as a commercial invoice. However, it should be clearly labeled “pro forma” or with some other language that reflects the fact that it is only an estimate and should not be paid until the work is done and the final invoice is issued.

Safran Modern Close Coupled Toilet

Safran Modern Close Coupled Toilet